Skrill Wallet

Overview

Introduction

Skrill Wallet is a payment method which allows to process payments in different currencies by using e-wallets in different countries. This method supports one-time and Credential-on-file (COF) purchases, refunds and payouts.

This article provides information about working with the Skrill Wallet method: general insights are presented in the Overview section, while information about the actions required to process payments and perform other actions is presented in the sections that follow.

General information

| Payment method type | digital wallet payments |

|---|---|

| Payment instruments | digital wallets |

| Countries and regions | most countries in the world |

| Payment currencies | AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD * |

| Currency conversion | – |

| One-time purchases | + |

| Credential-on-file purchases | + |

| Full refunds | + |

| Partial refunds | + |

| Payouts | + |

| Chargebacks | – |

| Notes | – |

| Onboarding and access fee | refer to your ecommpay key account manager, additional information available in the ecommpay shop |

* Specify the exact information with the ecommpay key account manager.

Interaction diagram

Payment processing by using the Skrill Wallet method involves the merchant's web service, one of ecommpay interfaces, the ecommpay payment platform, and technical facilities of the Skrill Wallet service.

Operations support

Various platform interfaces can be used to process payments and perform operations using the Skrill Wallet method. Purchases can be processed by using Payment Page, Gate and Dashboard (using payment links), refunds and payouts—by using Gate and Dashboard. At the same time, regardless of the interfaces used, the following limitations are applicable.

When working with the Skrill Wallet the following limitations are applicable.

| Amounts ¹ | ||

|---|---|---|

| minimum | maximum | |

| Purchases | 0.50 EUR (or equivalent) | 8,000.00 EUR (or equivalent) |

| COF payments | – | – |

| Refunds | – | – |

| Payouts | 10.00 USD (or equivalent) | 10,000.00 USD (or equivalent) |

- Specify the exact information with the ecommpay key account manager.

Processing scenarios

To perform a purchase by using the Skrill Wallet method, you need to redirect the customer to the Skrill Wallet service, while to make a refund, you need to receive a request from the customer and notify the customer about the result of the refund via the web service. To initiate a payout, you need to notify the customer via the web service.

The customer payment scenario via Payment Page looks like this.

General scenarios of processing purchases and payouts can be presented as follows.

One-time purchases by using Payment Page

General information

To process a purchase through Payment Page by using the Skrill Wallet method, the merchant's web service is required to send a request with all required parameters and signature to the ecommpay URL and receive a callback with the result. The full sequence and special aspects of purchase processing are provided below.

- A customer initiates a purchase in the web service.

- The web service sends the request for opening Payment Page to the specified ecommpay URL.

- The request for opening Payment Page is sent to the payment platform.

- The payment platform receives the request and validates the required parameters and signature.

- Payment Page is generated based on the project and request parameters.

- Payment Page is displayed to the customer.

- The customer selects the Skrill Wallet method.

- The payment platform receives the request for processing the payment by using the Skrill Wallet method.

- The payment platform processes the request and sends it to the Skrill Wallet service.

- The request is processed on the Skrill Wallet service side.

- The data for redirecting the customer to the Skrill Wallet service is sent from the Skrill Wallet service to the payment platform.

- The data for redirecting the customer is sent from the payment platform to Payment Page.

- The customer is redirected to the Skrill Wallet service.

- The customer completes all required payment steps.

- The purchase is processed in the Skrill Wallet service.

- The result information is displayed to the customer in the Skrill Wallet service.

- The customer is redirected to Payment Page.

- The Skrill Wallet service sends a notification about the result to the payment platform.

- The payment platform sends the payment result callback to the web service.

- The payment platform sends the result information to Payment Page.

- The result information is displayed to the customer on Payment Page.

Information about the formats of requests and callbacks used for processing payments by using the Skrill Wallet method via Payment Page is presented further in this section; general information about working with the Payment Page API is presented in Interaction concepts.

Request format

There are several things you need to consider when using the Skrill Wallet method:

- The following parameters required for any payment must be specified:

project_id—project identifier obtained from ecommpay during integrationpayment_id—payment identifier unique within the projectpayment_currency—payment currency code in the ISO-4217 alpha-3 formatpayment_amount—payment amount in the smallest currency unitcustomer_id—customer identifier unique within the project

- The following parameters required for any payment must be specified:

project_id,payment_id,payment_currency,payment_amount,customer_id. - Additionally, it is recommended to specify the email, first and last names of the customer in the parameters

customer_email,customer_last_nameandcustomer_first_name. If any of these parameters are missing, the payment form may display input fields for entering the missing values (details are available in Submission of additional payment information). - If you need to have the payment form displayed with the Skrill Wallet method selected, set the

force_payment_methodparameter toskrill. - Additionally, any other parameters available for working with Payment Page can be used (details).

- After all target parameters are specified, generate a signature (details).

Thus, a correct request for opening the payment form using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer information and signature.

{

"project_id": 120,

"payment_id": "580",

"payment_amount": 1000,

"payment_currency": "USD",

"customer_id": "customer1",

"customer_first_name": "John",

"customer_last_name": "Doe",

"customer_email": 'email@example.com',

"signature": "kUi2x9dKHAVNU0FYldOcZzUCwX6R\/ekpZhkIQg=="

}

{

"project_id": 120,

"payment_id": "580",

"payment_amount": 1000,

"payment_currency": "USD",

"customer_id": "customer1",

"customer_first_name": "John",

"customer_last_name": "Doe",

"customer_email": 'email@example.com',

"signature": "kUi2x9dKHAVNU0FYldOcZzUCwX6R\/ekpZhkIQg=="

}

Callback format

The Skrill Wallet method uses the standard format for callbacks to deliver purchase results. For more information, see Handling callbacks.

The following is the example of a callback with information about a 50,00 USD purchase made in the 68 project.

{

"project_id": 68,

"payment": {

"id": "86526901942",

"type": "purchase",

"status": "success",

"date": "2019-07-10T08:51:14+0000",

"method": "skrill",

"sum": {

"amount": 5000,

"currency": "USD"

},

"description": "Deposit"

},

"account": {

"number": "account@customer.com"

},

"customer": {

"id": "207"

},

"operation": {

"id": 21547000003559,

"type": "sale",

"status": "success",

"date": "2019-07-10T08:51:14+0000",

"created_date": "2019-07-10T08:50:59+0000",

"request_id": "arsthbvcab34",

"sum_initial": {

"amount": 5000,

"currency": "USD"

},

"sum_converted": {

"amount": 5000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2019-07-10T08:51:13+0000",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "Dnr3zBWrTAnz1C6fpYKOcha4H4VGx3eMaO8A0IfvQ=="

}

The following is the example of a callback with information about a declined purchase.

{

"project_id": 68,

"payment": {

"id": "15626281690123599",

"type": "purchase",

"status": "decline",

"date": "2019-07-09T23:22:59+0000",

"method": "skrill",

"sum": {

"amount": 10000,

"currency": "USD"

},

"description": "Deposit"

},

"customer": {

"id": "207"

},

"operation": {

"id": 21531000003532,

"type": "sale",

"status": "decline",

"date": "2019-07-09T23:22:59+0000",

"created_date": "2019-07-08T23:22:54+0000",

"request_id": "6e3cf13e8a76",

"sum_initial": {

"amount": 10000,

"currency": "USD"

},

"sum_converted": {

"amount": 10000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2019-07-08T23:22:56+0000",

"auth_code": ""

},

"code": "20105",

"message": "Insufficient funds on customer account"

},

"signature": "AiXDW6GnzyvtjMqPkvIo7d7e+t9i8nCh5p/d3JYL=="

}

Useful links

The following articles can be useful when implementing purchases via Payment Page:

- Interaction concepts—about the interaction with the payment platform by using Payment Page.

- Signature generation and verification—about the procedure of generating and verifying signatures in requests and callbacks.

- Payment processing—about the types, processing models, and possible statuses of supported payments and operations.

- One-time one-step purchase—about processing of one-time one-step purchases by using Payment Page.

- Handling operation processing information—about error and response codes that are used in the payment platform to record information about performing of operations.

One-time purchases by using Gate

General information

To process a purchase through Gate by using the Skrill Wallet method, the merchant's web service is required to do the following:

- Send a request with all the required parameters and signature to the ecommpay URL.

- Receive an intermediate callback from the payment platform and redirect the customer to the Skrill Wallet service.

- Receive the final callback from the payment platform.

The full sequence and special aspects of purchase processing are provided below.

- A customer initiates a purchase by using the Skrill Wallet method in the web service.

- The web service sends the request for processing the purchase by using Gate to the specified ecommpay URL.

- The payment platform receives the request.

- The payment platform validates the required parameters and signature in the request.

- The payment platform sends the response to the web service with information about the receipt of the request and its validity (details).

- The payment platform performs further processing of the request (with parameter consistency check) and sends it to the Skrill Wallet service.

- The request is processed on the Skrill Wallet service side.

- The Skrill Wallet service sends the redirection data to the payment platform.

- The payment platform sends the callback with the redirection data to the web service.

- The customer is redirected to the Skrill Wallet service.

- The customer completes all required payment steps.

- The purchase is processed in the Skrill Wallet service.

- The result is displayed to the customer.

- The customer is redirected to the web service.

- The Skrill Wallet service sends the payment result notification to the payment platform.

- The payment platform sends the payment result callback to the web service.

- The customer receives the payment result information from the web service.

Information about the formats of requests and callbacks used for processing payments by using the Skrill Wallet method via Gate is presented further in this section. General information about working with the Gate API is presented in Interaction concepts.

Request format

There are several things you need to consider when sending purchase requests by using the Skrill Wallet method:

- To initiate each purchase, send a separate POST request to the

/v2/payment/wallet/skrill/saleendpoint. This endpoint belongs to the group /v2/payment/wallet/{payment_method}/sale. - The following objects and parameters must be specified in the request:

- Object

general—general payout information:project_id—project identifier obtained from ecommpay during integrationpayment_id—payment identifier unique within the projectsignature—request signature generated after all required parameters are specified (details—in the Signature generation and verification) details

- Object

payment—payment information:amount—purchase amount in the smallest currency unitcurrency—purchase currency code in the ISO-4217 alpha-3 format

- Object

customer—customer information:id—customer identifier unique within the projectip_address—customer IP address relevant for the initiated payoutemail—customer email addressfirst_name—customer first namelast_name—customer last name

- Object

return_url—URLs for redirecting customers to the merchant web service:success— after processed paymentdecline—after declined paymentreturn—during payment processing

- Object

- Additionally, any other parameters included in the specification can be used.

Thus, a correct purchase request by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer information, URLs for redirection, as well as signature.

{

"general": {

"project_id": 238,

"payment_id": "SKRILL_SALE_12345",

"signature": "t8qap+aD70GdZwkd73UfSt9F7dni4/9WWIYcBZEL=="

},

"customer": {

"ip_address": "192.0.2.0",

"customer_email": "email@example.com",

"customer_last_name": "Johnson",

"customer_first_name": "John",

"id": "customer123"

},

"payment": {

"amount": 5000,

"currency": "USD",

"description": "skrill payment"

},

"return_url": {

"success": "http://example.com/success",

"decline": "http://example.com/decline",

"return": "http://example.com/return"

}

}

{

"general": {

"project_id": 238,

"payment_id": "SKRILL_SALE_12345",

"signature": "t8qap+aD70GdZwkd73UfSt9F7dni4/9WWIYcBZEL=="

},

"customer": {

"ip_address": "192.0.2.0",

"customer_email": "email@example.com",

"customer_last_name": "Johnson",

"customer_first_name": "John",

"id": "customer123"

},

"payment": {

"amount": 5000,

"currency": "USD",

"description": "skrill payment"

},

"return_url": {

"success": "http://example.com/success",

"decline": "http://example.com/decline",

"return": "http://example.com/return"

}

}

Formats of intermediate callbacks for customer redirection

Each payment made with the Skrill Wallet method requires redirection of customers from the merchant's web service to the Skrill Wallet service. To redirect a customer it is necessary to receive an intermediate callback from the payment platform and use the information included in the redirect_data object. The format of such callbacks is standard (details), and the following objects and parameters are included in the redirect_data object:

body—object with data to be sent in the request bodymethod—parameter specifying the HTTP method for sending the request (GETorPOST)url—parameter containing a link for redirection

"redirect_data": { "body": {}, "method": "GET", "url": "https://www.example.com/pay" }

Final callback format

The Skrill Wallet method uses the standard format for callbacks to deliver purchase results. For more information, see Handling callbacks.

The following is the example of a callback with information about a 50,00 USD purchase made in the 68 project.

{

"project_id": 68,

"payment": {

"id": "86526901942",

"type": "purchase",

"status": "success",

"date": "2019-07-10T08:51:14+0000",

"method": "skrill",

"sum": {

"amount": 5000,

"currency": "USD"

},

"description": "Deposit"

},

"account": {

"number": "account@customer.com"

},

"customer": {

"id": "207"

},

"operation": {

"id": 21547000003559,

"type": "sale",

"status": "success",

"date": "2019-07-10T08:51:14+0000",

"created_date": "2019-07-10T08:50:59+0000",

"request_id": "arsthbvcab34",

"sum_initial": {

"amount": 5000,

"currency": "USD"

},

"sum_converted": {

"amount": 5000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2019-07-10T08:51:13+0000",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "Dnr3zBWrTAnz1C6fpYKOcha4H4VGx3eMaO8A0IfvQ=="

}

The following is the example of a callback with information about a declined purchase.

{

"project_id": 68,

"payment": {

"id": "15626281690123599",

"type": "purchase",

"status": "decline",

"date": "2019-07-09T23:22:59+0000",

"method": "skrill",

"sum": {

"amount": 10000,

"currency": "USD"

},

"description": "Deposit"

},

"customer": {

"id": "207"

},

"operation": {

"id": 21531000003532,

"type": "sale",

"status": "decline",

"date": "2019-07-09T23:22:59+0000",

"created_date": "2019-07-08T23:22:54+0000",

"request_id": "6e3cf13e8a76",

"sum_initial": {

"amount": 10000,

"currency": "USD"

},

"sum_converted": {

"amount": 10000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2019-07-08T23:22:56+0000",

"auth_code": ""

},

"code": "20105",

"message": "Insufficient funds on customer account"

},

"signature": "AiXDW6GnzyvtjMqPkvIo7d7e+t9i8nCh5p/d3JYL=="

}

Useful links

The following articles can be useful when implementing purchases via Gate:

- Interaction concepts—about the interaction with the payment platform by using Gate.

- Signature generation and verification—about the procedure of generating and verifying signatures in requests and callbacks.

- Payment processing—about the types, processing models, and possible statuses of supported payments and operations.

- One-time one-step purchase—about processing of one-time one-step purchases by using Gate.

- Handling operation processing information—about error and response codes that are used in the payment platform to record information about performing of operations.

COF purchases by using Gate

General information

The Skrill Wallet payment method provides the ability to perform COF purchases of two types: OneClick and regular payments. For more information about COF purchases, see Credential-on-file (COF) purchases.

In the Skrill Wallet payment method, COF purchases of the OneClick type are performed by using the Skrill 1-Tap service. This service allows to make payments in "one tap" using previously saved e-wallet infromation.

COF payment registration

To register a COF payment by using Gate, the merchant is required to send a purchase request with all the required parameters, signature, and the COF purchase registration parameter recurring.register: true to the ecommpay URL and receive the callback with the payment result from the payment platform. To register a regular payment the request should also contain information about the frequency, amount, start and end dates of the regular payments.

In the COF purchase registration callback the web service receives the purchase identifier, which can be used to perform OneClick payments, as well as update, change conditions or cancel regular payments.

For more information about purchase processing by using Gate, see One-time purchases by using Gate.

Processing of COF purchases

After the payment is registered, customers can initiate a OneClick payment using the Skrill 1-Tap service, or the funds are debited automatically according to the specified regular payment conditions.

Updating the conditions of regular payments

At any time, you can change the conditions of regular payments, for example, change the processing time, the expiration date or the amount of debits. When conditions change, the withdrawal of funds from the customer account does not occur.

Cancellation of regular payments

Until the expiration date of a regular payment, you can cancel it.

Information about the formats of requests and callbacks used for processing payments by using the Skrill Wallet method via Gate is presented further in this section. General information about working with the Gate API is presented in Interaction concepts.

Requests format

There are several things you need to consider when sending COF purchase requests by using the Skrill Wallet method:

- To control the processing of COF purchases send a separate POST request to one of the following endpoints:

- /v2/payment/skrill/sale—to register COF purchases

- /v2/payment/skrill/1-tap—to perform OneClick payments

- /v2/payment/skrill/recurring/update—to update the regular payments performing conditions

- /v2/payment/skrill/recurring/cancel—to cancel the regular payments performing

- Each request must include the following objects and parameters:

- Object

general—general purchase information:project_id—project identifier obtained from ecommpay during integrationpayment_id—payment identifier unique within the projectsignature—request signature generated after all required parameters are specified (details—in the Signature generation and verification) (details)

- Object

payment—payment information:amount—payment amount in the smallest currency unitcurrency—payment currency code in the ISO-4217 alpha-3 format

- Object

customer—customer information:id—customer identifier unique within the projectip_address—customer IP address relevant for the initiated payment

- Object

recurring—COF purchase information:register—payment registration as a COF purchase (regular or OneClick)id—registered COF purchase identifierstart_date—the start date of regular payments, in theDD-MM-YYYYformat (must be at least one day later than the date of registration)expiry_year—regular payments end yearexpiry_month—regular payments end monthexpiry_day—regular payments end dayamount—amount of debitingperiod—regular payment performing periodinterval— regular payment performing intervaltime—regular payment performing time in thehh:mm:ss (UTC0)format

The required parameters in the

recurringobject depend on the type of request. For more information, see the API specification.

- Object

- Additionally, any other parameters included in the specification can be used.

A correct COF purchase registration request by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer identifier and IP address, the registration parameter, as well as signature.

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hltzO5GMSkzd0Iq6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0",

"id": "customer123"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"register": true

}

}

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hltzO5GMSkzd0Iq6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0",

"id": "customer123"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"register": true

}

}

A correct request for registration of a regular payment by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer identifier and IP address, the registration parameter and the conditions of regular payments, as well as signature.

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/ZtDSQ6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"register": true,

"amount": 1000,

"interval": 1,

"cycle": "week",

"start_date": "21-11-2018",

"expiry_year": 2025,

"expiry_month": 11,

"expiry_day": 25

}

}

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/ZtDSQ6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"register": true,

"amount": 1000,

"interval": 1,

"cycle": "week",

"start_date": "21-11-2018",

"expiry_year": 2025,

"expiry_month": 11,

"expiry_day": 25

}

}

A correct COF purchase processing request by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer identifier and IP address, identifier of the COF purchase, as well as signature.

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/Iq6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"id": 1234567890

}

}

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/Iq6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"id": 1234567890

}

}

A correct request for updating the conditions of a regular payment by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer identifier and IP address, identifier of the regular payment, information about new conditions, as well as signature.

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/ZtDSq6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"id": 1234567890,

"expiry_year": 2030,

"expiry_month": 11,

"expiry_day": 25

}

}

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/ZtDSq6lM2v8rmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"id": 1234567890,

"expiry_year": 2030,

"expiry_month": 11,

"expiry_day": 25

}

}

A regular payment cancellation request by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer identifier and IP address, identifier of the regular payment, as well as signature.

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/ZtDSQhmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"id": 1234567890

}

}

{

"general": {

"project_id": 238,

"payment_id": "TEST_15427007172789",

"signature": "DH0v2pZnkK9hwytQ6/ZtDSQhmWQV4sbP+4A==",

},

"customer": {

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 1000,

"currency": "EUR"

},

"recurring": {

"id": 1234567890

}

}

Callback format

The standard format for callbacks is used to deliver the results of actions with COF purchases. For more information, see Handling callbacks.

The following is the example of a callback with information about a COF purchase registration in the 238 project.

{

"project_id": 238,

"payment": {

"id": "SKRILL_1TAP",

"type": "recurring",

"status": "success",

"date": "2018-11-20T08:44:46+0000",

"method": "skrill",

"sum": {

"amount": 300,

"currency": "EUR"

},

"description": "skrill payment"

},

"account": {

"number": "customer@exmaple.com"

},

"recurring": {

"id": 1000030038,

"currency": "EUR",

"valid_thru": "-0001-11-30T00:00:00+0000"

},

"operation": {

"id": 1000034,

"type": "recurring",

"status": "success",

"date": "2018-11-20T08:44:46+0000",

"created_date": "2018-11-20T08:44:41+0000",

"request_id": "07fd7ade7cf010",

"sum_initial": {

"amount": 300,

"currency": "EUR"

},

"sum_converted": {

"amount": 300,

"currency": "EUR"

},

"provider": {

"id": 1132,

"payment_id": "2548950091",

"date": "2018-11-20T08:44:45+0000",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "x2tsnvLCRXZMX8Kwyr9acRq/yx56uZb7MTMdDEEg4w=="

}

The following is the example of a callback with information about updated conditions of a regular payment.

{

"project_id": 238,

"payment": {

"id": "SKRILL_SALE_ID",

"type": "purchase",

"status": "success",

"date": "2018-11-22T07:05:56+0000",

"method": "skrill",

"sum": {

"amount": 100,

"currency": "EUR"

},

"description": "skrill payment"

},

"recurring": {

"id": 1000034,

"currency": "EUR",

"valid_thru": "2018-11-29T00:00:00+0000"

},

"operation": {

"id": 1972,

"type": "recurring_update",

"status": "success",

"date": "2018-11-22T07:09:18+0000",

"created_date": "2018-11-22T07:09:16+0000",

"request_id": "ab70b4f9643bb0b",

"sum_initial": {

"amount": 0,

"currency": ""

},

"sum_converted": {

"amount": 0,

"currency": ""

},

"provider": {

"id": 1132,

"payment_id": "",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "dVpS1keJ0Bf0ofZRcAak+1nLPlD9rkjcKYUEtgpsMA=="

}

The following is the example of a callback with information about a cancelled regular payment.

{

"project_id": 238,

"payment": {

"id": "SKRILL_SALE_ID",

"type": "purchase",

"status": "success",

"date": "2018-11-22T07:05:56+0000",

"method": "skrill",

"sum": {

"amount": 100,

"currency": "EUR"

},

"description": "skrill payment"

},

"recurring": {

"id": 1000034,

"currency": "EUR",

"valid_thru": "2018-11-29T00:00:00+0000"

},

"operation": {

"id": 1973,

"type": "recurring_cancel",

"status": "success",

"date": "2018-11-22T07:14:51+0000",

"created_date": "2018-11-22T07:14:50+0000",

"request_id": "8d5ea1f970faaa76c4d10",

"sum_initial": {

"amount": 0,

"currency": ""

},

"sum_converted": {

"amount": 0,

"currency": ""

},

"provider": {

"id": 1132,

"payment_id": "",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "QHS5h1BVZqHS39wlzC0pfgSZMTizyQsossGDUVMAQ=="

}

The following is the example of a callback with information about a declined COF purchase registration.

{

"project_id": 238,

"payment": {

"id": "123456",

"type": "recurring",

"status": "decline",

"date": "2018-11-15T07:17:08+0000",

"method": "skrill",

"sum": {

"amount": 200,

"currency": "EUR"

},

"description": "skrill payment"

},

"errors": [

{

"code": "2701",

"message": "Rules Failed Code",

"description": "fatal: RULES_FAILED_CODE"

}

],

"recurring": {

"id": 100070,

"currency": "EUR",

"valid_thru": "-0001-11-30T00:00:00+0000"

},

"operation": {

"id": 10001868,

"type": "recurring",

"status": "decline",

"date": "2018-11-15T07:17:08+0000",

"created_date": "2018-11-15T07:17:08+0000",

"request_id": "e5ee540d420d6ccd",

"sum_initial": {

"amount": 200,

"currency": "EUR"

},

"sum_converted": {

"amount": 200,

"currency": "EUR"

},

"provider": {

"id": 1132,

"payment_id": ""

},

"code": "2701",

"message": "Rules Failed Code"

},

"signature": "SgrlW4XHS8dJdGW3lDLaqTBaNimdWxwwXYGjCsFI5ig=="

}

Useful links

The following articles can be useful when implementing purchases via Gate:

- Interaction concepts—about the interaction with the payment platform by using Gate.

- Signature generation and verification—about the procedure of generating and verifying signatures in requests and callbacks.

- Payment processing—about the types, processing models, and possible statuses of supported payments and operations.

- One-time one-step purchase—about processing of one-time one-step purchases by using Gate.

- Handling operation processing information—about error and response codes that are used in the payment platform to record information about performing of operations.

Refunds by using Gate

General information

To perform a refund through Gate by using the Skrill Wallet method, send a request with all required parameters and signature to the ecommpay URL and receive a callback with the result. The full sequence and special aspects of refund performing are provided below.

- A customer initiates a refund.

- The web service sends the request for performing the refund by using Gate to the specified ecommpay URL.

- The payment platform receives the request.

- The payment platform validates the required parameters and signature in the request.

- The payment platform sends the response to the web service with information about the receipt of the request and its validity (details).

- The payment platform performs further processing of the request (with parameter consistency check) and sends it to the Skrill Wallet service.

- The refund is processed on the side of the Skrill Wallet service.

- The Skrill Wallet service sends the result notification to the payment platform.

- The payment platform sends the result callback to the web service.

- The customer receives the refund result information from the web service.

Information about the formats of requests and callbacks used for performing refunds by using the Skrill Wallet method via Gate is presented further in this section. General information about working with the Gate API is presented in Interaction concepts.

Request format

There are several things you need to consider when sending refund requests by using the Skrill Wallet method:

- To initiate each refund, send a separate POST request to the /v2/payment/skrill/refund endpoint.

- Each request must include the following objects and parameters:

- Object

general—general refund information:project_id—project identifier obtained from ecommpay during integrationpayment_id—identifier of the payment that needs to be refundedpayment identifiersignature—request signature generated after all required parameters are specified (details—in the Signature generation and verification)

- Object

payment—refund information:description—refund description or commentamount—refund amount in the smallest currency unit (required for a partial refund)currency—refund currency code in the ISO-4217 alpha-3 format (required for a partial refund)

- Object

customer—customer information:id—customer identifier unique within the projectip_address—customer IP address relevant for the initiated refund

- Object

account—customer account information:number—email address linked to the wallet or account number;

- Object

- Additionally, any other parameters included in the specification can be used.

Thus, a correct refund request by using the Skrill Wallet method must contain the project and payment identifiers, description of the refund, the customer identifier and IP address, signature, and, if necessary, currency code and refund amount.

{

"general": {

"project_id": 239,

"payment_id": "refund_02",

"signature": "of8k9xerKSK4XL1QLTZYO56lCv+f1M0Sf/7eg=="

},

"customer": {

"ip_address": "192.0.2.0",

"id": "123456"

},

"account": {

"number": "customer@example.com"

},

"payment": {

"amount": 10000,

"currency": "USD",

"description": "refund_02"

}

}

{

"general": {

"project_id": 239,

"payment_id": "refund_02",

"signature": "of8k9xerKSK4XL1QLTZYO56lCv+f1M0Sf/7eg=="

},

"customer": {

"ip_address": "192.0.2.0",

"id": "123456"

},

"account": {

"number": "customer@example.com"

},

"payment": {

"amount": 10000,

"currency": "USD",

"description": "refund_02"

}

}

Callback format

The Skrill Wallet method uses the standard format for callbacks to deliver refund results. For more information, see Handling callbacks.

The following is the example of a callback with information about a 5,00 USD refund made in the 238 project.

{

"project_id": 238,

"payment": {

"id": "TEST_1540911136903",

"type": "purchase",

"status": "partially refunded",

"date": "2018-10-31T10:21:50+0000",

"method": "skrill",

"sum": {

"amount": 1000,

"currency": "USD"

},

"description": "TEST_1540911136903"

},

"account": {

"number": "98330562"

},

"customer": {

"id": "1"

},

"operation": {

"id": 19050000001772,

"type": "refund",

"status": "success",

"date": "2018-10-31T10:21:50+0000",

"created_date": "2018-10-31T10:21:48+0000",

"request_id": "798451cf786ffd28",

"sum_initial": {

"amount": 500,

"currency": "USD"

},

"sum_converted": {

"amount": 500,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "2528878875",

"date": "2018-10-31T10:21:50+0000",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "h7/6IhL12R8LtOGDG0sC6XiSZHCy+o/QycuAUw=="

}

}The following is the example of a callback with information about a declined refund.

{

"project_id": 238,

"payment": {

"id": "TEST_1540911136903",

"type": "purchase",

"status": "success",

"date": "2018-10-31T09:37:02+0000",

"method": "skrill",

"sum": {

"amount": 1000,

"currency": "USD"

},

"description": "TEST_1540911136903"

},

"account": {

"number": "98330562"

},

"customer": {

"id": "1"

},

"operation": {

"id": 19050000001771,

"type": "refund",

"status": "decline",

"date": "2018-10-31T10:18:52+0000",

"created_date": "2018-10-31T10:18:50+0000",

"request_id": "f93d3a958efde05af6416f1312b90dab09",

"sum_initial": {

"amount": 2000,

"currency": "USD"

},

"sum_converted": {

"amount": 2000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2018-10-31T10:18:51+0000",

"auth_code": ""

},

"code": "3283",

"message": "Refund amount more than init amount"

},

"signature": "tKGW0j0R9BqygpoG6f56vyl2IzHyK+c18LdhiDqrA=="

}

Useful links

The following articles can be useful when implementing refunds via Gate:

- Interaction concepts—about the interaction with the payment platform by using Gate.

- Signature generation and verification—about the procedure of generating and verifying signatures in requests and callbacks.

- Payment processing—about the types, processing models, and possible statuses of supported payments and operations.

- Purchase refunds—about performing of refunds by using Gate.

- Handling operation processing information—about error and response codes that are used in the payment platform to record information about performing of operations.

Payouts by using Gate

General information

To process a payout through Gate by using the Skrill Wallet method, send a request with all required parameters and signature to the ecommpay URL and receive a callback with the result. The full sequence and special aspects of payout processing are provided below.

- A customer initiates a payout by using the Skrill Wallet method in the web service.

- The web service sends the request for processing the payout by using Gate to the specified ecommpay URL.

- The payment platform receives the request.

- The payment platform validates the required parameters and signature in the request.

- The payment platform sends the response to the web service with information about the receipt of the request and its validity (details).

- The payment platform performs further processing of the request (with parameter consistency check) and sends it to the Skrill Wallet service.

- The payout is processed on the side of the Skrill Wallet service.

- The Skrill Wallet service sends the result notification to the payment platform.

- The payment platform sends the result callback to the web service.

- The customer receives the payout result information from the web service.

Information about the formats of requests and callbacks used for processing payouts by using the Skrill Wallet method via Gate is presented further in this section. General information about working with the Gate API is presented in Interaction concepts.

Request format

There are several things you need to consider when sending payout requests by using the Skrill Wallet method:

- To initiate each payout, send a separate POST request to the /v2/payment/skrill/payout endpoint.

- Each request must include the following objects and parameters:

- Object

general—general payout information:project_id—project identifier obtained from ecommpay during integrationpayment_id—payment identifier unique within the projectsignature—request signature generated after all required parameters are specified (details—in the Signature generation and verification) details

- Object

payment—payment information:amount—payout amount in the smallest currency unitcurrency—payout currency code in the ISO-4217 alpha-3 format

- Object

customer—customer information:id—customer identifier unique within the projectip_address—customer IP address relevant for the initiated payout

- Object

account—account information:number—account number

- Object

- Additionally, any other parameters included in the specification can be used.

Thus, a correct payout request by using the Skrill Wallet method must contain the project identifier, basic payment information (identifier, amount, and currency code), customer identifier and IP address, as well as account number and signature.

{

"general": {

"project_id": 35,

"payment_id": "Payment 12",

"signature": "2tlMuYxLW9Yu6RETr8pLyfbOQ+9ajAteg5lPk96Q=="

},

"customer": {

"id": "207",

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 5000,

"currency": "USD"

},

"account": {

"number": "account@example.com"

}

}

{

"general": {

"project_id": 35,

"payment_id": "Payment 12",

"signature": "2tlMuYxLW9Yu6RETr8pLyfbOQ+9ajAteg5lPk96Q=="

},

"customer": {

"id": "207",

"ip_address": "192.0.2.0"

},

"payment": {

"amount": 5000,

"currency": "USD"

},

"account": {

"number": "account@example.com"

}

}

Callback format

The Skrill Wallet method uses the standard format for callbacks to deliver payout results. For more information, see Handling callbacks.

The following is the example of a callback with information about a 50,00 USD payout made in the 68 project.

{

"project_id": 68,

"payment": {

"id": "86526901942",

"type": "payout",

"status": "success",

"date": "2019-07-10T08:51:14+0000",

"method": "skrill",

"sum": {

"amount": 5000,

"currency": "USD"

},

"description": "Credit"

},

"account": {

"number": "account@customer.com"

},

"customer": {

"id": "207"

},

"operation": {

"id": 21547000003559,

"type": "payout",

"status": "success",

"date": "2019-07-10T08:51:14+0000",

"created_date": "2019-07-10T08:50:59+0000",

"request_id": "arsthbvcab34",

"sum_initial": {

"amount": 5000,

"currency": "USD"

},

"sum_converted": {

"amount": 5000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2019-07-10T08:51:13+0000",

"auth_code": ""

},

"code": "0",

"message": "Success"

},

"signature": "Dnr3zBWrTAnz1C6fpYDZoyw4VGx3eMaO8A0IfvQ=="

}

The following is the example of a callback with information about a declined payout.

{

"project_id": 68,

"payment": {

"id": "15626281690123599",

"type": "payout",

"status": "decline",

"date": "2019-07-09T23:22:59+0000",

"method": "skrill",

"sum": {

"amount": 10000,

"currency": "USD"

},

"description": "Credit"

},

"customer": {

"id": "81801"

},

"account": {

"number": " jwrangler889@gmail.com"

},

"operation": {

"id": 21531000003532,

"type": "payout",

"status": "decline",

"date": "2019-07-09T23:22:59+0000",

"created_date": "2019-07-08T23:22:54+0000",

"request_id": "6e3cf13e8a76",

"sum_initial": {

"amount": 10000,

"currency": "USD"

},

"sum_converted": {

"amount": 10000,

"currency": "USD"

},

"provider": {

"id": 1132,

"payment_id": "",

"date": "2019-07-08T23:22:56+0000",

"auth_code": ""

},

"code": "20502",

"message": "Error during operation validation"

},

"signature": "AiXDW6GnzyvtjMq2sIo7d7e+t9i8nCh5p/d3JYL=="

}

Useful links

The following articles can be useful when implementing payouts via Gate:

- Interaction concepts—about the interaction with the payment platform by using Gate.

- Signature generation and verification—about the procedure of generating and verifying signatures in requests and callbacks.

- Payment processing—about the types, processing models, and possible statuses of supported payments and operations.

- Payouts—about processing of payouts by using Gate.

- Handling operation processing information—about error and response codes that are used in the payment platform to record information about performing of operations.

Testing

General information

For the Skrill Wallet method, it is possible to test purchases by using Payment Page and Gate, as well as refunds, payouts and OneClick (1-Tap) by using Gate. To enable and disable testing, as well getting assistance with setting up a test project, refer to ecommpay technical support.

When testing payments and operations keep in mind that the test project identifier must be indicated in requests and the interfaces of the emulator of Payment Page and Skrill Wallet payment forms can differ from the production environment.

Test payments statuses

The final status of test payments and operations is determined by the amount specified in the request.

Test one-time purchases:

declinestatus with40000or40400amountsuccessstatus with any other amount

Test refunds:

declinestatus with50000or50500amountsuccessstatus with any other amount

Test payouts:

declinestatus with40000or40400amountsuccessstatus with any other amount

Test OneClick payments:

- For registering a payment:

declinestatus with40000or40400amountsuccessstatus with any other amount

- For processing a payment:

-

declinestatus with80000or80800amountsuccessstatus with any other amount

It should also be noted, that processed OneClick payments are assigned different payment_id identifiers, and the same recurring_id identifier.

One-time purchases by using Payment Page

To perform a test purchase by using Payment Page, do the following:

- Send a correct test request for Payment Page opening to the payment platform.

- If the

skrillmethod was not specified in the request—select the method on the emulator page. - Click the Success or Decline button (depending on the amount specified in the request).

- Receive the final callback with information about the payment result.

More information about processing purchases by using the Skrill Wallet method via Payment Page is provided in the One-time purchases by using Payment Page section.

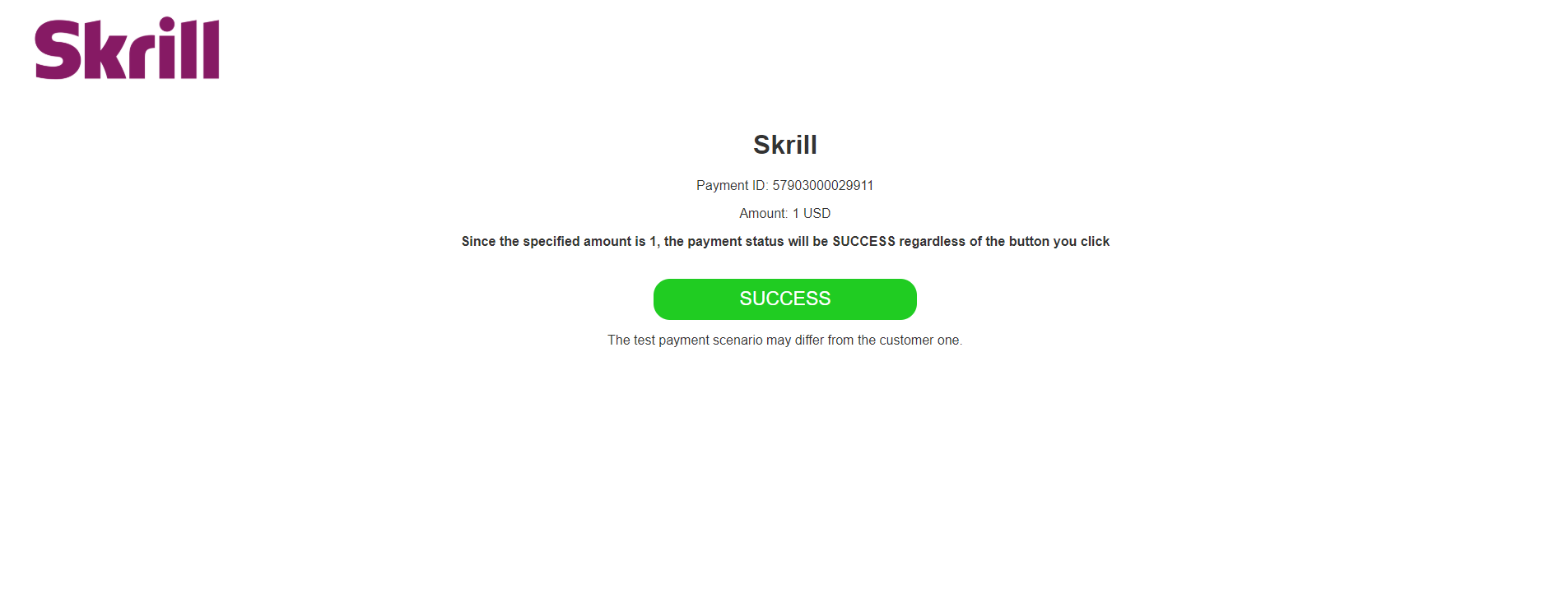

One-time purchases by using Gate

To perform a test purchase by using Gate, do the following:

- Send a correct test request for purchase to the payment platform.

- Accept a callback with redirection data.

- Go to the received URL and click the Success or Decline button (depending on the amount specified in the request).

- Receive the final callback with information about the payment result.

More information about processing purchases by using the Skrill Wallet method via Gate is provided in the One-time purchases by using Gate section.

OneClick payments by using Gate

To process a test OneClick payment by using Gate, send a valid test request for a payout to the payment platform and receive a final callback with information about the payout result. More information about processing COF purchases by using the Skrill Wallet method via Gate is provided in the COF purchases by using Gate section.

Refunds by using Gate

To perform a test refund by using Gate, send a valid test request for a refund of a previously processed test purchase to the payment platform and receive a final callback with information about the refund result. The test refund performing is possible only within a day after the initial purchase. More information about performing refunds by using the Skrill Wallet method via Gate is provided in the Refunds by using Gate section.

Payouts by using Gate

o process a test payout by using Gate, send a valid test request for a payout to the payment platform and receive a final callback with information about the payout result. More information about processing payouts by using the Skrill Wallet method via Gate is provided in the Payouts by using Gate section.

Analysis of payments results

To analyse information about payments made with the Skrill Wallet method and other methods, you can use:

- Dashboard interface toolkit with various lists and analytic panels.

- Reports in CSV file format, available via the Reports section (one-time and periodically).

- Data in JSON format, sent by program requests to a specified URL available by using the Data API interface.

If you have any questions, refer to the documentation (Dashboard and Using Data API) and ecommpay technical support.