SDK UI & Core for Android

Overview

Introduction

Mobile SDK UI & Core for Android is a software development kit with open-source code that can be used to integrate Android applications with the ecommpay payment platform.

SDK UI & Core for Android provides the functionality for interaction of customers with the user interface and for interaction of a mobile application with the payment platform which allows sending and receiving necessary information during payment processing. Additionally, the open-source code available with SDK UI & Core for Android provides flexibility for configuring the user interface in accordance with the aspects of the application.

SDK UI & Core for Android can be embedded in mobile applications developed for Android version 5.0 or later. The libraries and code examples are available on GitHub. To access, use the following URLs:

- List of SDK UI & Core for Android releases: https://github.com/ITECOMMPAY/mobile-sdk-android-ui/releases

- Code examples: https://github.com/ITECOMMPAY/mobile-sdk-android-ui/tree/master/integration-example

Capabilities

The following functional capabilities are supported by SDK UI & Core for Android:

- Processing different types of payments made with cards and Google Pay as well as other payment methods available for the merchant's project. Supported payment types include:

- One-time one-step purchases.

- One-time two-step purchases (an authorisation hold can be placed via the SDK and subsequent debiting of the authorised amount is carried out via Gate or Dashboard).

- COF purchases (they can be registered via the SDK and then managed via Gate or Dashboard).

Note: In case of card and Google Pay payments, the payment interface described in this article is used. With other payment methods, Payment Page is used during payment processing. - Performing payment card verification (it involves debiting a zero amount from the customer's card).

- Checking current payment information.

- Auxiliary procedures and additional capabilities to boost payment acceptance rates:

- Submission of additional payment information.

- Payment retries.

- Cascade payment processing.

- Collecting customer data.

- Additional capabilities to improve user experience:

- Saving customer payment data.

- Payment interface language support.

- Sending email notifications with the list of purchased items to customers.

- Customising the appearance of the payment interface including the colour scheme settings and the option to add the logo.

Workflow

Generally, the following workflow is relevant when one-step purchases are processed with the use of SDK UI & Core for Android.

- In the user interface of a mobile application, the customer initiates a purchase by clicking the payment button or in a different fashion set up on the merchant side.

- In the mobile application, a set of parameters for creating a payment session is generated. Then, with the help of SDK UI & Core for Android, this set is converted into a string for signing, and the string is sent to the server side of the merchant web service.

- On the server side of the merchant web service, the parameters can be checked and supplemented if necessary, and the signature to the final parameter set is generated, following which the prepared data is sent back to SDK UI & Core for Android.

- With the help of SDK UI & Core for Android, a payment session is initiated in the payment platform.

- On the payment platform side, the payment interface is prepared in accordance with the invocation parameters, and the data for opening the interface is passed to the customer's device.

- In the mobile application, the payment form is displayed to the customer.

- The customer selects a payment method (if no method was selected when the payment session was initiated), specifies the necessary information, and confirms the purchase.

- SDK UI & Core for Android sends a purchase request to the payment platform.

- On the payment platform side, the payment is registered and all necessary technical actions are performed; these actions include sending the required data to the payment environment—to the providers and payment systems.

- The payment is processed in the payment environment. Then the payment result information is received in the payment platform.

- In the payment platform, the information about the payment result is processed and a callback is sent to the server side of the web service.

- The information about the purchase result is sent from the payment platform to SDK UI & Core for Android.

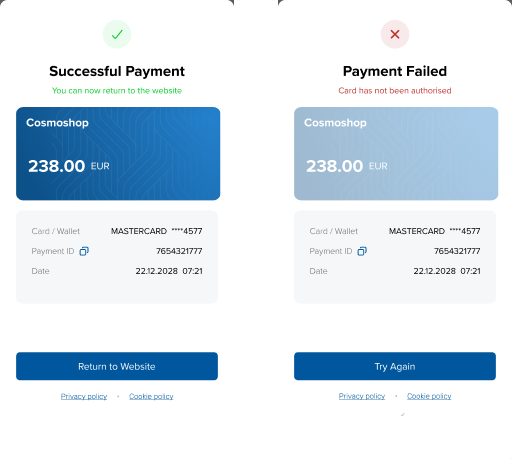

- The notification with the result information is displayed to the customer in the user interface.

Interface

When card and Google Pay payments are processed, the customer interacts with the user interface designed by the ecommpay specialists. This user interface can be customised: you can change its colour and add your company's logo.

Setup

Integration steps

To integrate the web service with the ecommpay payment platform by using SDK UI & Core for Android:

- Address the following organisational issues of interaction with ecommpay:

- If your company has not obtained a project identifier and a secret key for interacting with ecommpay, submit the application for connecting to the ecommpay payment platform.

- If your company has obtained a project identifier and a secret key for interacting with ecommpay, inform the technical support specialists about the company's intention to integrate by using SDK UI & Core for Android and coordinate the procedure of testing and launching the functionality.

- Complete the following preliminary technical steps:

- Download and link the SDK UI & Core for Android libraries.

- Ensure the collection of data necessary for opening the payment form. The minimum data set needed in order to open the payment form consists of the project, payment, and customer identifiers as well as of the payment amount and currency.

- Ensure signature generation for the data on the server side of the mobile application.

- Ensure the receipt of and the response to the notifications from SDK UI & Core for Android as well as the receipt of and the response to the callbacks from the payment platform on the web service side.

- With the technical support specialists, coordinate the timeline and the main steps of integrating, testing (including testing available payment methods), and launching the solution.

- For testing, use the test project identifier and the details of test cards.

- For switching to the production mode, change the value of the test project identifier to the value of the production project identifier received from ecommpay.

If you have any questions about working with SDK UI & Core for Android, contact the ecommpay technical support specialists (support@ecommpay.com).

Libraries installation

For the mobile applications developed for Android version 5.0 or later, linking the SDK UI & Core for Android libraries via MavenCentral is supported. To link the libraries:

- Open the

build.gradle.ktsmodule in the application. - Specify the

mavenCentralrepository in therepositoriessection:allprojects { repositories { google() mavenCentral() } } - Add the following code in the

dependenciessection:implementation "com.ecommpay:msdk-ui:LATEST_VERSION"

Signature generation

Make sure that the data is signed on the server side of the web service with the use of the secret key received from ecommpay. To work with the signature, you can use ready-to-use components, such as language-specific SDKs for web services (details), or your own in-house solutions. The procedure of working with the signature is described in Signature generation and verification.

Testing

Before you start processing real payments via SDK UI & Core for Android, it is recommended that you test payment processing in the test project. You can obtain the identifier and the secret key of the test project when accessing the ecommpay test environment (this can be done via an application on the company's main site). Along with that, upon the coordination with the ecommpay specialists, it is possible to test the use of the Google Pay method and additional capabilities, such as cascade payment processing and collection of customer data.

To test payment processing:

- Open the

build.gradle.ktsmodule in the application. - Specify the test project identifier (

projectId) and the secret key of the given project (projectSecretKey). - Run the

gradlesynchronisation process.

To switch to the production mode, change the test values (the identifier and the secret key of the test project) to the production ones.

Use

Opening payment form

SDK UI & Core for Android supports such actions as performing one-time purchases and placing authorisation holds as part of executing two-step purchases, registering COF purchases and performing payment card verification. To initiate these actions, you need a certain parameter set. The required minimum of parameters is passed in the EcmpPaymentInfo object while other parameters can be passed in the EcmpPaymentOptions object, requested from the customer, or received from the payment platform.

To open the payment form:

- Create the

EcmpPaymentInfoobject.- This object must contain the following required parameters:

projectId(integer)—a project identifier assigned by ecommpaypaymentId(string)—a payment identifier unique within the projectpaymentCurrency(string)—the payment currency code in the ISO 4217 alpha-3 formatpaymentAmount(integer)—the payment amount in the smallest currency unitcustomerId(string)—a customer's identifier within the projectsignature(string)—a request signature generated after all required parameters have been specified

- You can also add any other parameters listed in the following table.

val ecmpPaymentInfo = EcmpPaymentInfo( projectId = 77655, paymentId = payment_322, paymentAmount = 100, paymentCurrency = "USD", paymentDescription = "Cosmoshop payment", customerId = "customer_003", regionCode = "DE", //Code of the customer's country token = "o8i7u65y4t3rkjhgfdw3456789oikjhgfdfghjkl...", //Token associated with certain payment data languageCode = "de", //Payment interface language code receiptData = "eyAKICAicG9zaXRpb25zIjpbIAogICAgIIjoxLAogICAgICAgICJhbW91bnQiOjU5OTAsCiAgQ==", //Data to be included in the notification with the list of the purchased items hideSavedWallets = false, //Parameter to enable hiding or displaying saved payment instruments forcePaymentMethod = card //Identifier of the preselected payment method ) - This object must contain the following required parameters:

- Sign the parameters contained in the

EcmpPaymentInfoobject.ecmpPaymentInfo.signature = SignatureGenerator.generateSignature( paramsToSign = ecmpPaymentInfo.getParamsForSignature(), secret = SECRET_KEY ) - Create the

EcmpPaymentOptionsobject.- This object must contain the following parameters:

- For all payments—the

actionTypeparameter with the value specifying the required operation type:Sale,Auth, orVerify. - For card payments—the

CUSTOMER_EMAILor theCUSTOMER_PHONEparameter embedded in theadditionalFieldsobject (at least one of the two) to display the corresponding fields to the customer on the payment form.

- For all payments—the

- For 3‑D Secure it is recommended that you specify the customer's billing address information:

BILLING_COUNTRY—the country of the customer's billing address in the ISO 3166-1 alpha-2 format (details)BILLING_POSTAL—the postal code of the customer's billing addressBILLING_CITY—the city of the customer's billing addressBILLING_ADDRESS—the street of the customer's billing address

These parameters are passed in the

additionalFieldsobject and the corresponding fields are displayed to the customer on the payment form.Note: According to Visa, rigorous use of these parameters can significantly increase payment acceptance rates (up to 6 %) and drastically decrease the number of operations flagged as fraudulent after they have been processed (up to 65 %). - You can also add any other objects and parameters listed in the following table.

In addition to the required

EcmpPaymentInfoobject and theactionTypeparameter, the following example contains theCUSTOMER_EMAILparameter required for card payments and several additional parameters including the ones listed in theadditionalFieldsobject.val paymentOptions = paymentOptions { paymentInfo = ecmpPaymentInfo actionType = EcmpActionType.Sale brandColor = "#800008" isDarkTheme = false logoImage = BitmapFactory.decodeResource(resources, R.drawable.example_logo) hideScanningCards = false isTestEnvironment = true merchantId = BuildConfig.GPAY_MERCHANT_ID merchantName = "Example Merchant Name" screenDisplayModes { mode(EcmpScreenDisplayMode.HIDE_DECLINE_FINAL_SCREEN) mode(EcmpScreenDisplayMode.HIDE_SUCCESS_FINAL_SCREEN) } additionalFields { field { type = EcmpAdditionalFieldType.CUSTOMER_EMAIL value = "mail@mail.com" } field { type = EcmpAdditionalFieldType.CUSTOMER_FIRST_NAME value = "firstName" } } } - This object must contain the following parameters:

- Create the

EcmpPaymentSDKobject.val sdk = EcmpPaymentSDK( context = applicationContext, paymentOptions = paymentOptions, )If necessary, you can open the payment form in the test mode in order to get information about errors if there were any when payment parameters were specified or to test processing payments with a certain payment result. In the

EcmpPaymentSDKobject, specify theEcmpPaymentSDK.EcmpMockModeType.SUCCESSvalue for themockModeTypeparameter (if you need to receiveSuccesspayment result). You can also pass valuesEcmpPaymentSDK.EcmpMockModeType.DECLINE(if you need to receiveDeclinepayment result) andEcmpPaymentSDK.EcmpMockModeType.DISABLED(if you need to switch to the production mode). - Open the payment form.

sdk.openPaymentScreen(this, 1234)

Processing payments

By default, SDK UI and Core for Android allows processing one-step purchases (action type Sale). This type of checkout works right out-of-the-box and requires no additional setup.

In addition, SDK UI and Core for Android supports processing two-step purchases (which involves placing an authorisation hold via the SDK and subsequent debiting of the authorised amount). To perform a two-step purchase:

- Open the payment form with

EcmpActionType.Authspecified as a value for the action type parameter in thepaymentOptionsobject:(EcmpPaymentOptions.EcmpActionType.Auth);

- When needed, initiate debiting of the authorised amount via Dashboard (details) or Gate (by sending the request to the /v2/payment/card/capture endpoint).

Payment card verification

Payment instrument verification can be used when you need to validate a card without withdrawing funds instantly (for example, before performing a payout) or when you need to save card details for subsequent use. It is essentially a payment that involves debiting a dummy (zero) amount from the customer's card.

To perform verification, open the payment form with EcmpActionType.Verify specified as a value for the action type parameter in the paymentOptions object:

(EcmpPaymentOptions.EcmpActionType.Verify);

Payment status information

To receive payment result notifications, use the onActivityResult method.

override fun onActivityResult(requestCode: Int, resultCode: Int, data: Intent?) {

super.onActivityResult(requestCode, resultCode, data)

when (resultCode) {

EcmpPaymentSDK.RESULT_SUCCESS -> {

Toast.makeText(this, "Payment was finished successfully", Toast.LENGTH_SHORT).show()

Log.d("PaymentSDK", "Payment was finished successfully")

}

EcmpPaymentSDK.RESULT_CANCELLED -> {

Toast.makeText(this, "Payment was cancelled", Toast.LENGTH_SHORT).show()

Log.d("PaymentSDK", "Payment was cancelled")

}

EcmpPaymentSDK.RESULT_DECLINE -> {

Toast.makeText(this, "Payment was declined", Toast.LENGTH_SHORT).show()

Log.d("PaymentSDK", "Payment was declined")

}

EcmpPaymentSDK.RESULT_ERROR -> {

val errorCode = data?.getStringExtra(EcmpPaymentSDK.EXTRA_ERROR_CODE)

val message = data?.getStringExtra(EcmpPaymentSDK.EXTRA_ERROR_MESSAGE)

Toast.makeText(this, "Payment was interrupted. See logs", Toast.LENGTH_SHORT).show()

Log.d(

"PaymentSDK",

"Payment was interrupted. Error code: $errorCode. Message: $message"

)

}

}

}

Possible payment result codes:

RESULT_SUCCESS—payment has been completed.RESULT_CANCELLED—payment has been cancelled.RESULT_DECLINE—payment has been denied.RESULT_ERROR—error occurred when the payment was being processed.

Additional capabilities

Submitting additional payment information

Generally, for processing a payment, it is enough to send a set of parameters that are mandatory for its initiation. However, in some cases, a payment system or a provider can require additional data necessary for processing a particular payment. This can be due to region-specific requirements, the need for an additional anti-fraud check, or other factors. The information about submitting additional payment data is provided in the following article.

The final set of required parameters can vary depending on a specific provider or a payment system. The list of parameters relevant for a particular payment is displayed to the customer on the payment form. The customer fills in the required data, confirms the payment, and receives the payment result information.

Cascade payment processing

In case of a payment attempt failure, the capability of cascade payment processing can be used (details). This capability implies executing a sequence of payment attempts via alternative providers without the payment method change and can be set up upon coordination with the ecommpay specialists.

If this capability is set up for the project in use, then after the first unsuccessful attempt, a notification is received from SDK UI & Core for Android. This notification contains the cascading_with_redirect = true attribute-value pair. Along with that, the error page with the button to retry making the payment is shown to the customer. If the 3‑D Secure authentication is not required as part of the additional attempt, then the attempt is executed without any further interaction with the customer. Otherwise, a separate page opens for repeating the authentication process.

Collecting customer data

In some cases, alongside the mandatory parameters, it can be relevant to require the additional ones (such as phone numbers and email addresses) from the customers. To have this capability set up, the merchant should decide which data has to be mandatory to be specified by the customers and communicate data collection preferences to the technical support specialists. For more information about using the capability, see the separate article.

Payment interface language support

By default, during the work with SDK UI & Core, the payment interface is localised according either to the language of the customer's device—if this language is supported for the project in use—or to a language set as default for other cases (generally, English). Along with that, if relevant, you can localise the payment interface for particular sessions. For this, every request for opening the payment form must contain a corresponding language code in the languageCode (details).

The following languages are supported for the SDK interface and can be promptly set up in the projects of the payment platform.

| Language | Language code |

|---|---|

| English | en |

| Estonian | et |

| French | fr |

| German | de |

| Italian | it |

| Latvian | lv |

| Lithuanian | lt |

| Portuguese | pt |

| Spanish | es |

| Ukrainian | uk |

Saving payment data

SDK UI & Core for Android allows saving payment data of the customer for subsequent processing of payments without the need for the said customer to re-enter such data. This capability is set up individually for each project. The merchant has to let the technical support know which of the two options is preferable: always save payment data or ask the customer to select the option. For more information about this capability, refer to article Saving customer payment data.

As a result of saving payment data, a separate identifier is generated for each payment instrument. This identifier is associated with the identifier of a certain customer (customerId). To display saved payment data to the customer, pass false in the hideSavedWallets parameter of the EcmpPaymentOptions object.

Payment form opening parameters

When working with SDK UI & Core for Android, you can pass the following optional parameters in the EcmpPaymentInfo object.

| Parameter | Description |

|---|---|

|

|

Description of the payment. A string that contains between 1 and 255 characters. Example: |

|

|

Data to be included in the notification with the list of the purchased items, passed as a JSON object encoded using the Base64 scheme. Example: |

|

|

Token associated with certain payment data. A string that contains between 1 and 255 characters. Example: |

|

|

Parameter to enable hiding or displaying saved payment instruments in the payment form. Possible values:

|

|

|

The identifier of the preselected payment method according to the table. Example: |

|

|

Object that contains additional objects and parameters necessary for the 3‑D Secure 2 authentication. |

|

|

Payment interface language code in the ISO 639-1 alpha-2 format. Must match one of the languages supported for the given project. Example: |

|

|

Code of the customer's country in the ISO 3166-1 alpha-2 format. Example: |

You can pass the following optional parameters in the EcmpPaymentOptions object.

| Parameter | Description |

|---|---|

|

|

The Google Pay identifier of the merchant. |

|

|

The Google Pay name of the merchant. |

|

|

A bitmap file that contains the logo of the merchant. |

|

|

Payment interface colour in hexadecimal format. Example: |

|

|

Parameter to indicate a test payment. Possible values:

|

|

|

Additional fields that contain information about the customer. Example: |

|

|

|

|

|

Card number. Example: |

|

|

First and last name (as specified on the card). Example: |

|

|

Number of the wallet. Example: |

|

|

First and last name of the recipient. Example: |

|

|

Code of the recipient's country in the ISO 3166-1 alpha-2 format. Example: |

|

|

Recipient's address. Example: |

|

|

Recipient's city of residence. Example: |

|

|

Recipient's state. Example: |

To work with COF purchases, you should pass relevant parameters in the recurrentData object of the EcmpPaymentOptions object.

| Parameter | Description |

|---|---|

|

|

COF purchase type:

|

|

|

Debiting period for a regular purchase. Possible values:

|

|

|

Expiration day of the COF purchase. |

|

|

Expiration month of the COF purchase. |

|

|

Expiration year of the COF purchase. |

|

|

Identifier assigned to the payment within which scheduled debits are performed (for automatic debiting); it must differ from the identifier of the payment made to register a COF purchase and must be unique within the project. Parameter must be passed together with the |

|

|

Date to perform the first debit in the dd-mm-yyyy format. Parameter must be passed together with the scheduled_payment_id parameter. |

|

|

Time when to perform a scheduled debit (for regular purchases) in the hh:mm:ss format, passed if the period parameter is specified as well. |

|

|

|

|

|

The amount to debit in the smallest currency unit. |

|

|

Date to perform the debit in the dd-mm-yyyy format. |

You can pass the following optional parameters in the ecmpThreeDSecureInfo object. Including these parameters increases the possibility of frictionless flow selection.

| Parameter | Description |

|---|---|

threeDSecureInfo—object of the ECMPThreeDSecureInfo class containing additional objects and parameters used during the 3‑D Secure 2 authentication |

|

threeDSecurePaymentInfo—object of the ECMPThreeDSecurePaymentInfo class with information about the purchase details and indication of the preferable authentication flow |

|

|

|

This parameter indicates whether challenge flow is requested for this payment. Possible values:

|

|

|

The dimensions of a window in which authentication page opens. Possible values:

|

|

|

The date the preordered merchandise will be available. Format: dd-mm-yyyy. |

|

|

This parameter indicates whether cardholder is placing an order for merchandise with a future availability or release date. Possible values:

|

|

|

This parameter indicates whether the cardholder is reordering previously purchased merchandise. Possible values:

|

threeDSecureGiftCardInfo—object of the ECMPThreeDSecureGiftCardInfo class with information about payment with prepaid card or gift card. |

|

|

|

Amount of the payment with prepaid or gift card denominated in the smallest currency unit. |

|

|

Currency code of the payment with prepaid or gift card in the ISO 4217 alpha-3 format, for example GBP. |

|

|

Total number of individual prepaid or gift cards/codes used in purchase. |

threeDSecureCustomerInfo—object of the ECMPThreeDSecureCustomerInfo class with information about the customer. |

|

|

|

The parameter indicates whether the customer billing address matches the address specified in the Possible values:

|

|

|

State, province, or region code in the ISO 3166-2 format. Example: DOR for Dorset. |

|

|

Customer home phone number. Numeric, from 4 to 24 characters. Example: |

|

|

Customer work phone number. Numeric, from 4 to 24 characters. Example |

threeDSecureAccountInfo—object of the ECMPThreeDSecureAccountInfo class with information about customer account details on record with the web service |

|

|

|

Additional customer account information, for instance arbitrary customer ID. Maximum 64 characters. |

|

|

Number of card payment attempts in the last 24 hours. Maximum 3 characters ( |

|

|

Number of card payment attempts in the last 365 days. Maximum 3 characters ( |

|

|

Number of days since the customer account was created. Possible values:

|

|

|

Any additional log in information in free text. Maximum 255 characters. |

|

|

Authentication type the customer used to log on to the account when placing the order. Possible values:

|

|

|

Account log on date and time. Format: dd-mm-yyyyhh:mm. |

|

|

Account creation date. Format: dd-mm-yyyy. |

|

|

Last account change date except for password change or password reset. Format: dd-mm-yyyy. |

|

|

Number of days since last customer account update, not including password change or reset. Possible values:

|

|

|

Last password change or password reset date. Format: dd-mm-yyyy. |

|

|

Number of days since the last password change or reset. Possible values:

|

|

|

Card record creation date. Format: dd-mm-yyyy. |

|

|

Number of days since the payment card details were saved in a customer account. Possible values:

|

|

|

Number of attempts to add card details in customer account in the last 24 hours. Maximum 3 characters ( |

|

|

Number of purchases with this cardholder account in the previous six months. Maximum 4 characters ( |

|

|

Suspicious activity detection result. Possible values:

|

threeDSecureShippingInfo—object of the ECMPThreeDSecureShippingInfo class with shipping details. |

|

|

|

Shipping address. Maximum 150 characters. |

|

|

First shipping address usage date. Format: dd-mm-yyyy. |

|

|

Number of days since the first time usage of the shipping address. Possible values:

|

|

|

Shipping city. Maximum 50 characters. |

|

|

Shipping country in the ISO 3166-1 alpha-2 format, for example GB. |

|

|

The email for the digital content delivery. Maximum 255 characters. |

|

|

Shipment terms. Possible values:

|

|

|

Shipment recipient flag. Possible values:

|

|

|

Shipping postbox number. Maximum 16 characters. |

|

|

State, province, or region code in the ISO 3166-2 format. Example: If you specify this parameter, you need also to specify and populate the |

|

|

Shipment indicator. Possible values:

|

threeDSecureMpiResultInfo—object of the ECMPThreeDSecureMpiResultInfo class with information about previous customer authentication |

|

|

|

The ID the issuer assigned to the previous customer operation. Maximum 36 characters. |

|

|

The flow the issuer used to authenticate the cardholder in the previous operation. Possible values:

|

|

|

Date and time of the previous successful customer authentication |